Baltimore City has suffered a serious and precipitous decline in the amount of small-business loan capital deployed over time. According to a study of the lending environment by the Johns Hopkins University 21st Century Cities Initiative, between 2007 and 2016, the total number of small-business loans and the total dollar amount loaned decreased from 17,084 loans totaling $457 million in 2007 to 8,274 loans totaling $307 million in 2016. The drop in loan activity over time reflects the challenges that small businesses experience in securing access to capital in the traditional financial lending market, as lenders are unwilling or unable to take on the risk associated with such loans.

The Abell Foundation has long been supportive of growing the entrepreneurial infrastructure and small-business ecosystem in Baltimore City to promote business expansion, job creation, and wealth formation, especially for Black entrepreneurs and entrepreneurs of color. The Foundation has supported a number of community-based efforts to expand access to financing and business support, including:

- Crowdfunding Efforts in Support of Baltimore’s Small Businesses: Baltimore Corps/Kiva Baltimore and Community Wealth Builders/Maryland Neighborhood Exchange

- Expanding Loan Capital and Business Technical Assistance: Latino Economic Development Center and Baltimore Community Lending

Crowdfunding Efforts in Support of Baltimore’s Small Businesses

Online crowdfunding platforms and corresponding technical assistance and support allow small businesses to access previously untapped investments from individuals and facilitates financing outside of the traditional bank loan model. Small businesses can approach investors for loans that will allow them, for example, to expand inventory, purchase needed equipment, or undertake other expenses that will lead to business growth. Crowdfunding also serves as a low-cost marketing tool, and provides an opportunity for the small business to showcase itself, its product, and its aspirations. It allows individual residents and investors to support local and small businesses through a low financial threshold that can have a large impact.

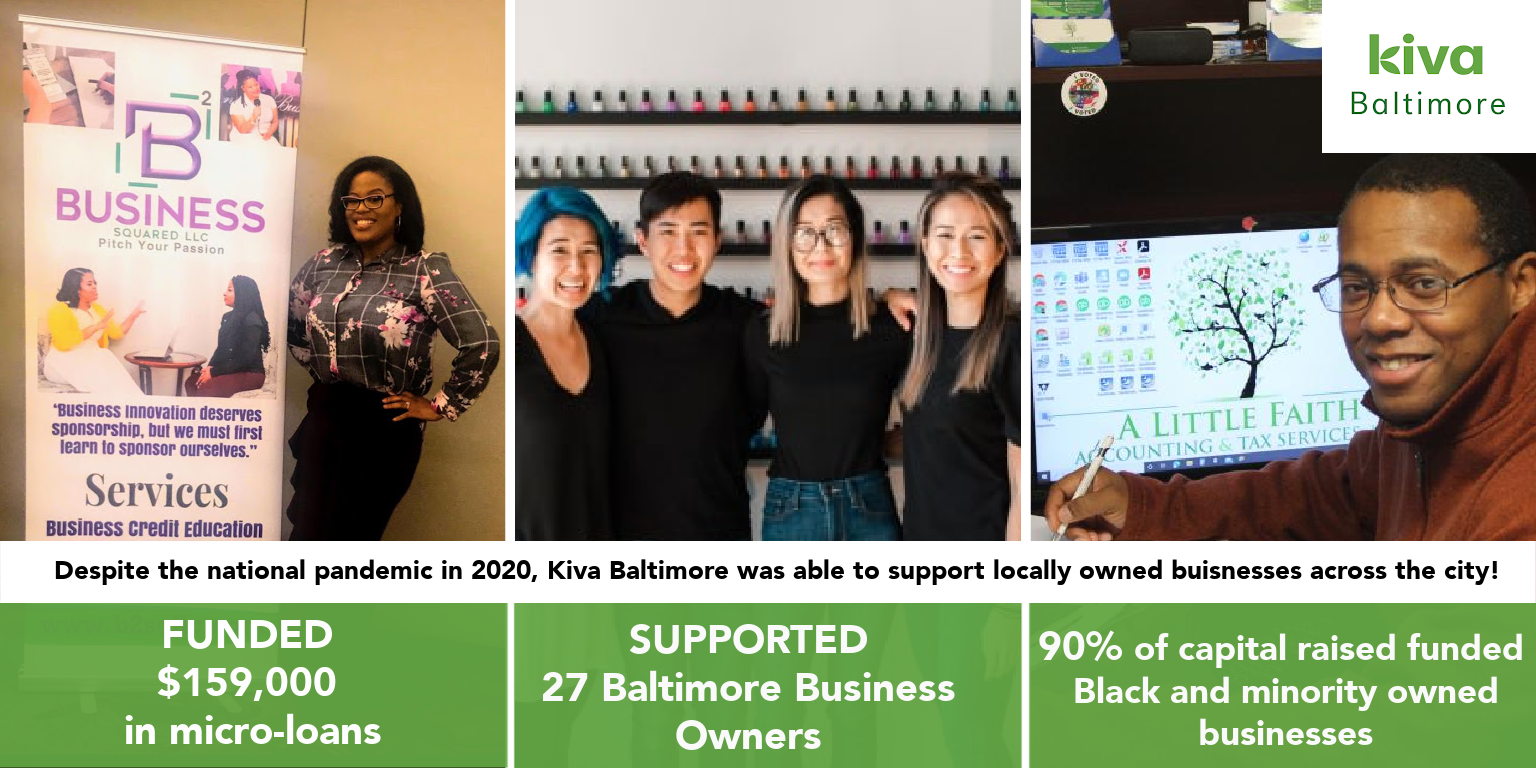

Baltimore Corps/Kiva Baltimore

Kiva is a U.S. tech platform that serves entrepreneurs around the world. Through this platform, users can make loans to entrepreneurs for as little as $25. A borrower applies for a loan of up to $15,000 that is then underwritten through a local intermediary or lending institution that then approves the loan. Loans are disbursed directly by Kiva to the borrowers. Baltimore Corps relaunched the Kiva Baltimore program in Baltimore in early 2019 with grant support from the Abell Foundation and other funders. At scale, Baltimore Corps will grow lending on the Kiva Baltimore platform to $1 million annually. From July 1, 2021 through February 2022, Baltimore Corps has supported 14 entrepreneurs totaling $88,000 in micro-loans, with the average loan size of $6,300. Of these businesses, 100% were minority-owned, 86% were Black-owned, and 71% were women-owned.

Kiva Baltimore was critical to filling a gap in funding during the pandemic, as many of its entrepreneurs struggled to access relief capital through the traditional financial systems that presently contribute to inequities in lending. Kiva supported 12 borrowers applying to the Economic Recovery Fund, and nine borrowers found funding from a variety of programs including the Paycheck Protection Program (PPP), Maryland State grants, Baltimore City grants, and Economic Injury Disaster Loans (EIDL). Kiva Baltimore seeks to connect entrepreneurs with larger, more impactful capital to continue stimulating growth beyond Kiva, and it has successfully referred entrepreneurs to the Maryland Neighborhood Exchange program discussed below.

Community Wealth Builders/Maryland Neighborhood Exchange

Community Wealth Builders (CWB) sees the Maryland Neighborhood Exchange as a possible next step for successful Kiva businesses as their businesses grow and need additional capital. The Exchange utilizes grassroots investment crowdfunding that was legalized in 2016 and is regulated by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

CWB’s goal is to provide a triple bottom line: Community residents can build new assets through their investments, while beneficiary businesses not only obtain the capital they need, but also solidify their ties with customers and others who become investors. When residents take a financial stake in a local business, they tend to patronize and promote it more, enhancing the vibrancy and resilience of the local economy, and fostering new job creation. Investment crowdfunding enables businesses to get the capital they need directly from their customers and the community they serve.

Launched in December 2019, the Maryland Neighborhood Exchange has helped 48 local businesses raise over $3.3 million from more than 6,500 investors. With grant support from the Abell Foundation in 2020, the Maryland Neighborhood Exchange has deepened its work in two Baltimore City communities: Market Center and Southwest Baltimore.

CWB provides in-depth technical assistance to businesses in each neighborhood interested in investment crowdfunding. Additionally, CWB educates groups of community residents and stakeholders about investment crowdfunding, with the goal of empowering them to participate in local investment options.

Expanding Loan Capital and Business Technical Assistance

Another primary way to address small-business needs is to support the capacity of community nonprofit lenders called Community Development Financial Institutions (CDFIs). Unlike federal- or state-chartered lenders, CDFIs can more easily offer innovative loan products and flexible lending practices to give small businesses access to the investment capital and financial services they need to prosper and grow.

Latino Economic Development Center

In 2014, with support from the Abell Foundation and Baltimore City Community Development Block Grant funding, Latino Economic Development Center (LEDC) expanded its microlending program from the Washington metro area into Baltimore City. LEDC saw an opportunity to increase the amount of capital available for small-business development and growth, especially among businesses owned by Latinos, other immigrants, and people of color. LEDC created new full-time bilingual Spanish-English staff in Baltimore in small-business lending and coaching to provide additional technical assistance. LEDC provides small-business microloans ranging from $5,000 to $50,000, consumer loans for credit-building or citizenship ranging from $725 to $1,000, and the technical assistance to support business development and growth.

The Abell Foundation has continued to award grants to LEDC every year since their launch in Baltimore City. During the 2022 fiscal year, staff conducted 12 workshops with a total of 173 participants and provided 97 aspiring and existing small business owners with 730 hours of one-on-one coaching. Staff originated five consumer loans and three small business loans totaling $292,500. In the prior year, LEDC closed 25 business loans in Baltimore totaling $359,237. Of these, 19 were made to businesses owned by people of color. Business owners project that they will be able to retain 12 existing full-time jobs and 6 part-time equivalent jobs and create one new full-time position. Their coaching assisted entrepreneurs across a variety of sectors, including food, construction, childcare and cleaning services, helping to create one new business.

Baltimore Community Lending

Founded in 1989, Baltimore Community Lending (BCL), a local CDFI, expanded to offer small-business lending in addition to its broad portfolio of real estate development and redevelopment project financing. The Abell Foundation has awarded multiple grants to support expansion of staff, marketing and outreach to small businesses, IT investments, and creation of a loan loss reserve to expand BCL’s capital resources through participation in the U.S. Small Business Administration’s microloan program.

Since its first small business loan in August 2018, BCL has made 44 loans to 38 small businesses disbursing over $2.6 million in Baltimore City neighborhoods. Of those loans, 83% were made to people of color; 60% were made to women; 42% were made to low- and moderate-income clients; and 67% were made to businesses located in low- and moderate-income neighborhoods. These loans have resulted in the creation of more than 32 full time jobs and 18 part time jobs and have helped retain at least 30 more. With active management and forbearance agreements established during COVID, to date, there have been no loan losses. These small businesses provide jobs in underserved neighborhoods, food in food deserts, and products and services that are not otherwise available, and they generate reuse of vacant buildings. By providing capital to emerging and growing small businesses, Baltimore Community Lending stimulates small-business growth in neighborhoods suffering from historic disinvestment and reduces racial wealth disparities by supporting Black-owned businesses and businesses owned by people of color to get a foothold and grow.

Photos courtesy of Latino Economic Development Center and Baltimore Corps/Kiva Baltimore.