Analyzing the most recent data from the American Community Survey and American Housing Survey, Johns Hopkins University graduate student Philip M.E. Garboden pinpoints a “Double Crisis” in Baltimore’s affordable rental market: an income crisis and a rent crisis. Together, these crises are causing a downward spiral of hardship, uncertainty, and dislocation for families across Baltimore.

The first crisis is driven by the city’s poverty. In Baltimore, 34 percent of families who rent live below the poverty line—totaling approximately 19,000 families and 150,000 individuals. These families face a private market that is consistently unaffordable. The second crisis, which Garboden terms a “rent crisis,” affects families earning between $20K and $75K. Since rents have risen sharply in recent years, families are paying an ever-increasing amount of income on rent, creating unprecedented struggles in Baltimore’s middle-market neighborhoods.

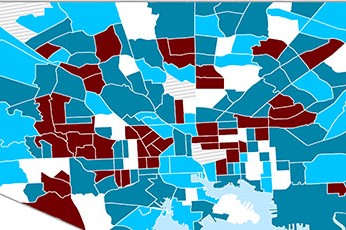

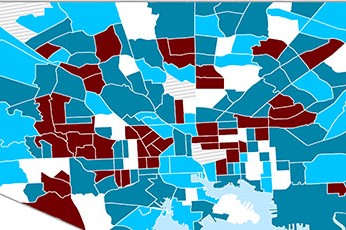

The maps and figures in this report illustrate the depth of this double crisis and where it is most deeply felt. The appendix provides a breakdown of the changing rent costs, neighborhood by neighborhood.